Propelld Domestic Education Loan Apply: Students studying in colleges are getting education loan from propelled company in India known as Propelld Domestic Education Loan. Students are getting Rs 10 lakh loan amount to complete their undergraduate or postgraduate courses without financial burden. If you are also looking to get a final assistance for your education program then you can check the Propelld Domestic Education Loan program in this article where we will discuss with you the eligibility criteria, application procedure, interest rates, loan amount etc. it will help you to understand the Propelld Domestic Education Loan scheme.

Domestic loan education program is very helpful for students who are currently studying in schools or education institutes to acquire higher education. Propelld company is famous to provide loan to the students across the country under various program. Currently we are discussing the domestic education loan program of the company where you can get up to maximum 1000000 rupees loan amount to complete your education.

Benefits of Propelld Domestic Education Loan

- Study now pay later facility: The bank is offering opportunity to pay the loan amount after completing the education. Student who are studying can apply for the loan program and once they get a good job, will start to repay the loan amount with a small EMI.

- Long term repayment period: Students will get facility to create their EMI for a long time according to the financial condition.

- Students studying 3rd or fourth year in UG or PG courses will get the opportunity to create their EMI for a long time.

- The company is offering a minimum 6 month to maximum 84 months loan tenure. So students can pay the loan amount according to their financial condition.

- Students can get loan amount from rs 50000 rupees to maximum 10 lakh rupees according to their course structure and fees structure in the specific course.

Propelld domestic education loan eligibility

Candidates are required to follow the following eligibility criteria before applying for the education loan in Propelld company:

- Only Indian students are eligible to apply for the education loan in this company.

- The minimum age of the student should be at least 21 years old while applying for the loan.

- Students should study in a regular course from any recognised University for UG or PG level.

- The student should studying a professional or a job oriented course where the student should have surety to get instant job after completing the course. So it will easier for company to provide maximum loan.

- The candidate is required to achieve at least 60% marks in the previous semester or year to be eligible for getting the education loan

Important documents

You are required to provide the following documents in PDF on the official website of the company. So it is important to prepare the PDF in clear image:

- Aadhar card of the applicant

- Latest passport size photograph

- Bank account passbook of the applicant

- Admission certificate or document

- Fees structure of the course in a specific institute or college.

- Last year marksheet of the student

- Last 6 months bank statement of the applicant.

- Mobile number and email ID

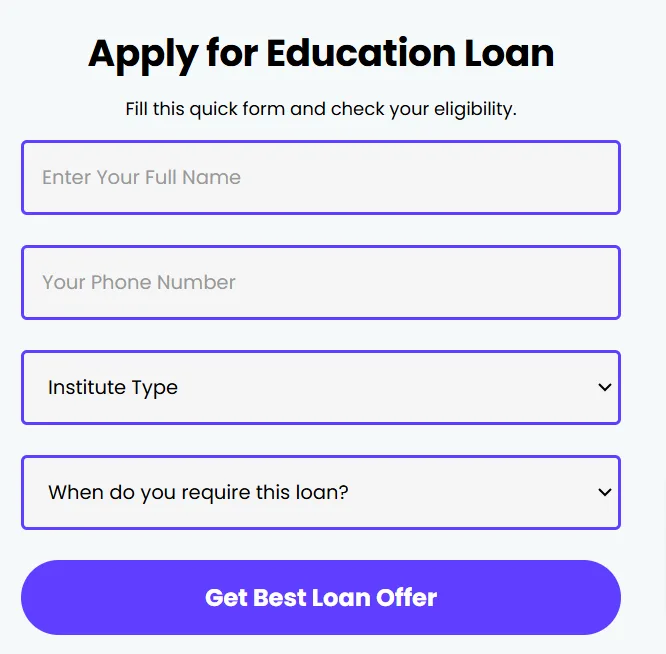

Propelld Domestic Education Loan Application procedure

Applicants are required to submit the application form through online mode by following this step by step procedure on the official website of propelld loan company.

- Firstly visit on the website by clicking on this link: https://propelld.com/

- Now you will reach the new page where you have to click on the apply loan section

- It will ask you to provide your mobile number and email ID for registration and after that you will get OTP for verification

- Once you create your registration in the page, you have to fill the loan application form where you need to provide the educational details, course details, fees structure, income criteria etc.

- After that you have to enter the loan amount which you want to get and have to opt for the EMI.

- At the end you have to upload your all the documents in sequence in PDF

Once you complete the application you will get a final OTP for final verification and after that your application form will be successfully submitted. Company will send you an acknowledgement number and will soon contact you to release the loan amount in your bank directly.

Propelld domestic education loan interest rate

It is important to check the interest rates and all the hidden charges by the company while applying for the education loan. As per the official notification of the company, applicant will be all to provide loan amount from 12% to 18% according to the eligibility and other conditions. However it can be increased if you delay your EMI or withdraw your loan in middle of the tenure.